The Cellar: a friendly neighborhood coffee shop, with no coffee and no shop. Established 1990.

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

Tax Time

It's tax time again, thinking wispally about the good old days when my tax check would come just in time to pay my car insurance.

I haven't gotten a refund since I don't know when, at least a dozen years.

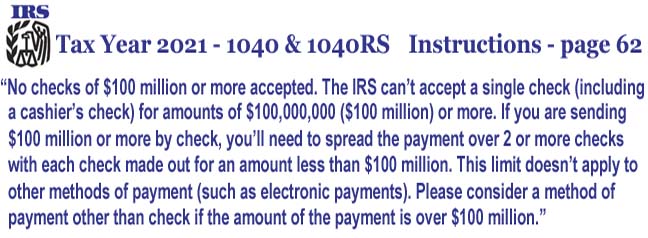

Get to the point. OK, reading the instruction booklet for the 1040 and 1040 SR forms I found this...

Freedom is just another word for nothin' left to lose.

- Happy Monkey

- Member

Offline

Offline - From: DC

- Registered: 10/13/2020

- Posts: 554

Re: Tax Time

A refund means you gave them an interest-free loan. As long as you have enough to cover it, it's better to have to send a check, even if you have to split it into multiple checks.

_______________

|_______________| We live in the nick of times.

| Len 17, Wid 3 |

|_______________|[pics]

- tw

- Member

Offline

Offline - Registered: 10/16/2020

- Posts: 1,730

Re: Tax Time

Happy Monkey wrote:

A refund means you gave them an interest-free loan. .

Who cares when interest rates still remain at near zero?

- Clodfobble

- Hella Proactive

Offline

Offline - From: Austin, TX

- Registered: 10/13/2020

- Posts: 902

Re: Tax Time

Happy Monkey wrote:

A refund means you gave them an interest-free loan. As long as you have enough to cover it, it's better to have to send a check, even if you have to split it into multiple checks.

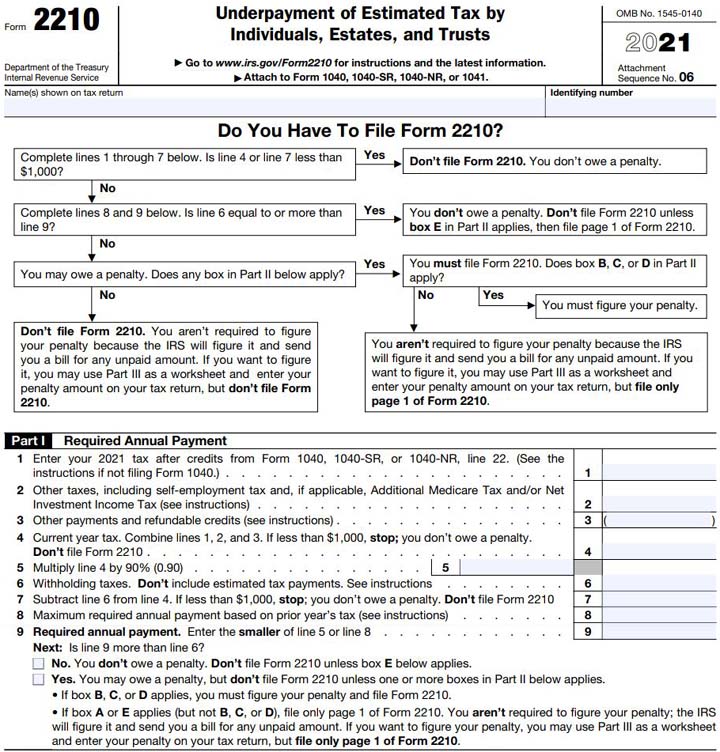

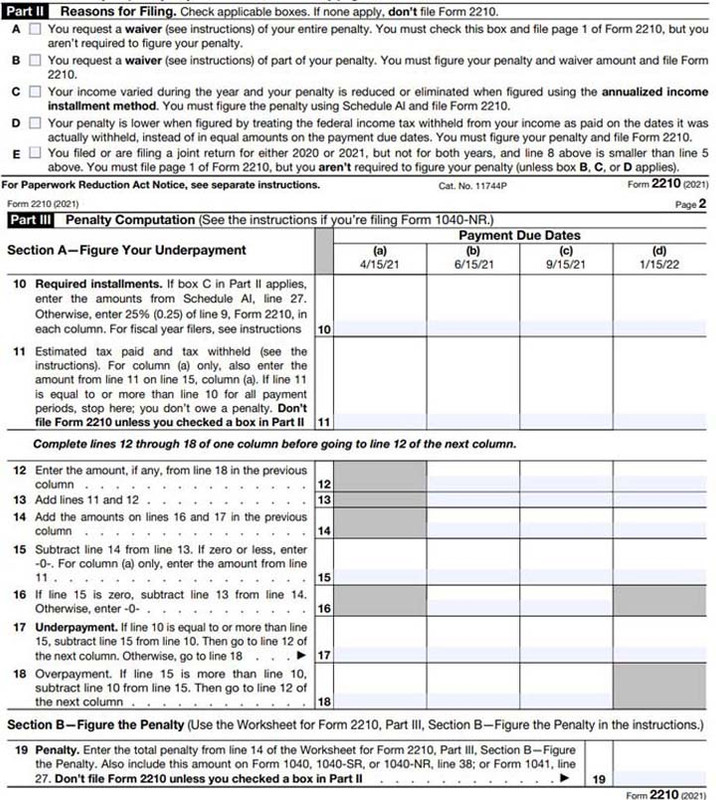

Legally, though, they can penalize you for that. You get one freebie year of owing them, because you can claim you didn't expect it based on last year's finances. But if you have two years in a row of owing them money, they can, theoretically at least, come after you for not making quarterly pre-payments. (If you did make quarterly pre-payments that line up with what you owed last year, and it turns out you just made even more this year, you're in the clear.)

- glatt

- TM

Offline

Offline - From: Arlington VA

- Registered: 10/13/2020

- Posts: 1,223

Re: Tax Time

Taxes are complicated. My wife was entering info as I was reading off figures from the reporting forms, and she didn't click the question mark on the spend 5 months as a full time student to be claimed as a qualified child dependent question, to get the detailed explanation of the rule, and we went from having a big refund to owing money because we didn't check that box. (our boy had 3.5 months or so as a student) It seemed wrong, but we're in a transition point of life with kids becoming adults so I figured we must have just entered the no kids stage. Well, just to double check, I started Googling the rule, and after reading the IRS publication that discusses it, I saw it was "any part of 5 months" so late August to early December is 5 months even if it was only 3.5 months of actual time and it made a couple thousand dollars worth of difference. Turned out OK in the end, but what a pain in the ass. And took a couple of weekend afternoons to get 'er done.

It's a lot easier when you just do the same thing every year.

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

Re: Tax Time

I only owed a little under $500 this year but it's been as high as $2700 and that's a nono.

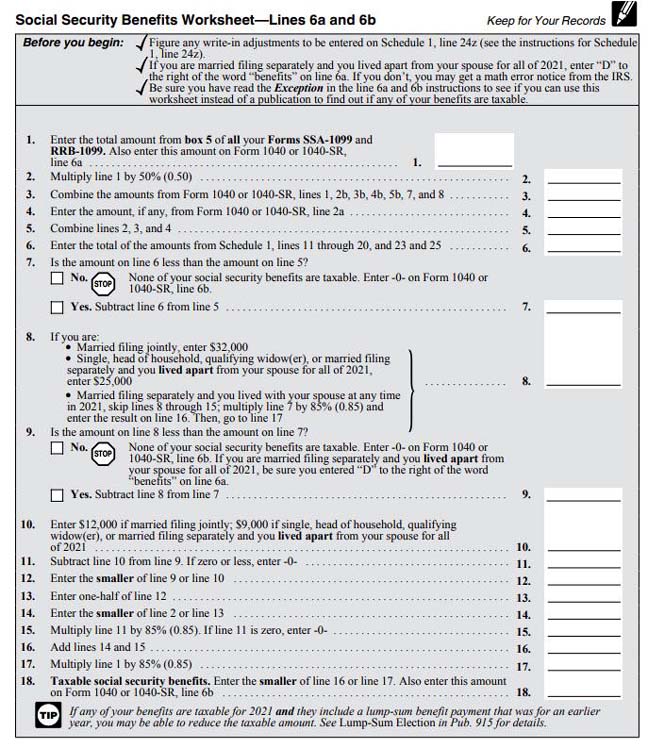

My problem is depending on how much other income I have determines how much of my social security is taxable.

That's another clusterfuck figuring that out...

The biggest pain is sifting the instructions for shit that applies to you but not the other 99 situations.

Then the penalty, although there's an option to leave it blank for them to calculate.

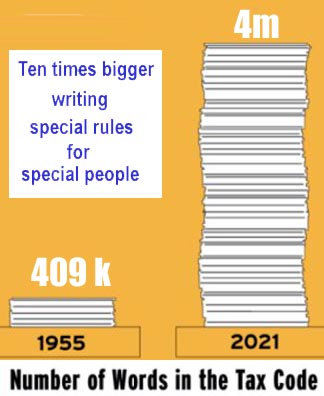

Somewhere out there a lobbyist is broadly smiling.

Freedom is just another word for nothin' left to lose.

- •

- glatt

- TM

Offline

Offline - From: Arlington VA

- Registered: 10/13/2020

- Posts: 1,223

Re: Tax Time

Ugh. So I've got that to look forward to in a few years. Whee!

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

Re: Tax Time

Freedom is just another word for nothin' left to lose.

- •

- Carruthers

- Member

Offline

Offline - From: Buckinghamshire UK

- Registered: 10/13/2020

- Posts: 260

Re: Tax Time

Heavens above! I thought that UK tax returns were of Byzantine complexity.

Thankfully I haven't had to complete a tax return for years.

Details of my income are passed to HMRC who kindly deduct what they think I owe them.

In the closing months of 2021/22 I received a refund of £28 (c $35) closely followed by a notice of coding which invites me to pay an increased amount for 2022/23.

No doubt they've over estimated it again and a small amount will come back in due course of events.

- tw

- Member

Offline

Offline - Registered: 10/16/2020

- Posts: 1,730

Re: Tax Time

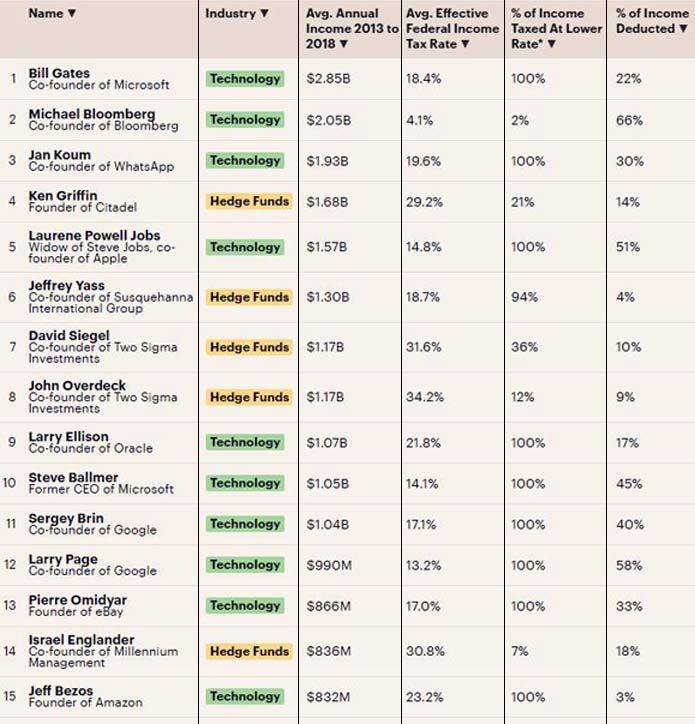

Donald Trump would constantly brag that he paid almost no taxes. Somehow that makes him popular especially among the KKK, Nazis, and White Supremacists.

But now his tax accountants refuse to stand behind his tax returns for the past ten years. Something about deception, fraud, misinformation, and other complications.

Except for Jeff Bezos, business school disciples, who do nothing productive and only manipulate money, paid least taxes.

Problem is not limited to people who play money games. GE paid near zero or no taxes for the past 20 years. Since the purpose of a business is profits - enriching top management - products be damned.

Last edited by tw (5/01/2022 1:16 pm)

1 of 1

1 of 1