The Cellar: a friendly neighborhood coffee shop, with no coffee and no shop. Established 1990.

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

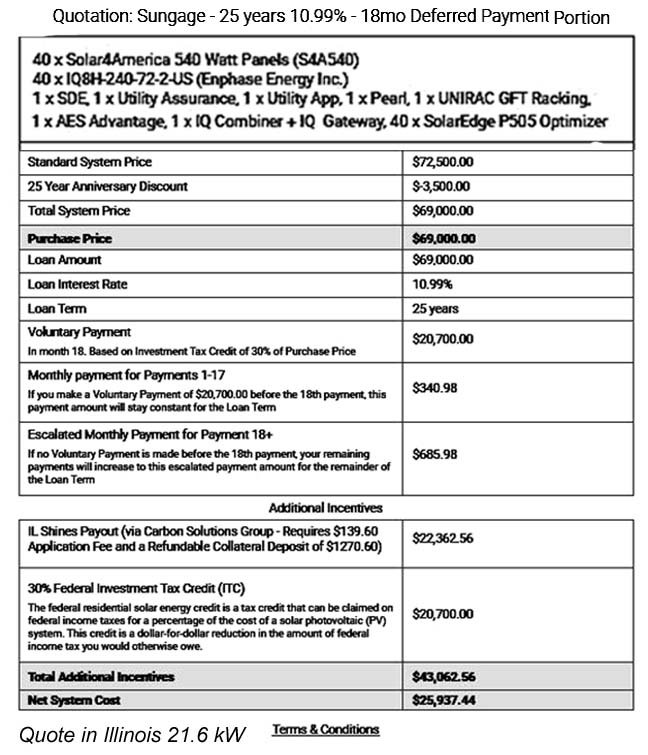

Cost of solar power for a home in Illinois.

I saw this proposal posted online. It's a big system with 40 of the 540 watt panels which would put out 21.6 kW under perfect conditions.

The dark complected slave in the fuel supply is that $20,700 tax credit.

First you have to owe Uncle Sam more than $20,700 to claim the credit then you give it to the solar folks instead of the tax man.

So you can't deduct that from the cost of the system, you're still paying it to someone. Tricky head games.

But still, $69,000 is less than an awful lot of cars on the road.

But you have to figure out how to store it in order to be prepared for nights, blackouts, storms and such.

Freedom is just another word for nothin' left to lose.

- Happy Monkey

- Member

Offline

Offline - From: DC

- Registered: 10/13/2020

- Posts: 554

Re: Cost of solar power for a home in Illinois.

If you owe it in taxes anyway, then you can consider it deducted from the cost of the system. Without the credit, you'd be paying that much to both of them.

_______________

|_______________| We live in the nick of times.

| Len 17, Wid 3 |

|_______________|[pics]

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

Re: Cost of solar power for a home in Illinois.

I disagree, if the taxman chooses to give you a break on your taxes because you bought this system or and electric car or anything else, that's a reduction in your taxes. Whether the taxman gives you a break or not the solar company still gets their total price including the $20,700. All they are doing is delaying that lump for 18 months.

Freedom is just another word for nothin' left to lose.

- •

- Happy Monkey

- Member

Offline

Offline - From: DC

- Registered: 10/13/2020

- Posts: 554

Re: Cost of solar power for a home in Illinois.

I was talking about the cost of the system to you, not the amount of money the solar company gets. They get the full amount up front in either case.

But with the tax rebate, you get some of it back.

(rounding the numbers here)

IE, if you owe $50,000 in taxes and don't buy the solar panels, you still owe $50,000 in taxes.

If you owe $50,000 in taxes, buy the $70000 system, and there's no rebate, you pay $120,000.

If you owe $50,000 in taxes, buy the $70000 system, and there's a $30,000 rebate then you pay $120,000, eventually get $30,000 back, and you are out $90,000 total, which is $30,000 less than if there weren't a rebate.

_______________

|_______________| We live in the nick of times.

| Len 17, Wid 3 |

|_______________|[pics]

- tw

- Member

Offline

Offline - Registered: 10/16/2020

- Posts: 1,731

Re: Cost of solar power for a home in Illinois.

Not included is the massive amount paid to professionals. Who are now necessary to know all these rules. And charge handsomely for doing something that is otherwise unproductive.

- xoxoxoBruce

- The Future is Unwritten

Offline

Offline - Registered: 10/15/2020

- Posts: 4,355

Re: Cost of solar power for a home in Illinois.

Happy Monkey wrote:

I was talking about the cost of the system to you, not the amount of money the solar company gets. They get the full amount up front in either case.

But with the tax rebate, you get some of it back.

(rounding the numbers here)

IE, if you owe $50,000 in taxes and don't buy the solar panels, you still owe $50,000 in taxes.

If you owe $50,000 in taxes, buy the $70000 system, and there's no rebate, you pay $120,000.

If you owe $50,000 in taxes, buy the $70000 system, and there's a $30,000 rebate then you pay $120,000, eventually get $30,000 back, and you are out $90,000 total, which is $30,000 less than if there weren't a rebate.

I agree that the rebate helps your bottom line, BUT my point was that's between you and the taxman the solar folks still get their $69,000 regardless. It's written up like they are giving you another $20,700 off.

Like when I told Toad he could get a healthy rebate from the state on his EV.

If he had not claimed that $1000 from the state Tesla wouldn't give a rats patootie, they got theirs.

The numbers...

Loan $69,000 @ 10.99% for 25 years = 300 payments.

Payments are $340.98 x 17 months = $5,796.66

Month 18 “Voluntary” payment = $20,700

$340.98 x 282 months = $96,497.34

-------------------------------------------------------

total = $122,994

Payments $340.98 x 17 months = $5,796.66

“Voluntary” payment = $0

up $345 to $685.98 x 283 months = $194,132.34

-------------------

total = $199,929

--------------------

total difference = $76,935

I'll bet $20,700 of that $76,935 goes to the Solar company and the rest is interest for loaning it to you.

I don't understand that Shines payment of $22,362.26.

Google says... "As of December 2023, an SREC is worth $83.75 for solar systems under 10 kW (most residential systems), and $76.27 for systems between 10–25 kW. Contact Certasun to understand current pricing." and it's taxable. This one is 21.6 kW

For $140 application fee and $1240 refundable collateral deposit. WTF?

You pay $140 to have them find out if you're in line for a piece of the pie Why the $1240.

Ahh, I'll bet if you get pie it's paid direct to you and the $1240 is to make sure they get their "commission".

Then they have $25,937.34 net cost for the system.

C'mon, crazy claims, you know better, probably selling used cars yesterday.

Freedom is just another word for nothin' left to lose.

- •

1 of 1

1 of 1